Principal Amount

- 3000

- 5L

Total Interest Payable

- 6

- 38

Loan Term (in months)

- 3

- 72

Select Language :

Unexpected expense knocking at your door? Whether it’s a medical emergency, urgent travel, home repairs, or education fees, a ₹30,000 personal loan can give you the support you need, quickly and without hassle.

You can now apply for this loan through trusted lenders with minimal documentation and fast approvals. With interest rates starting from 1.5% per month and flexible tenures from 6 to 18 months, repayment becomes smooth and stress-free.

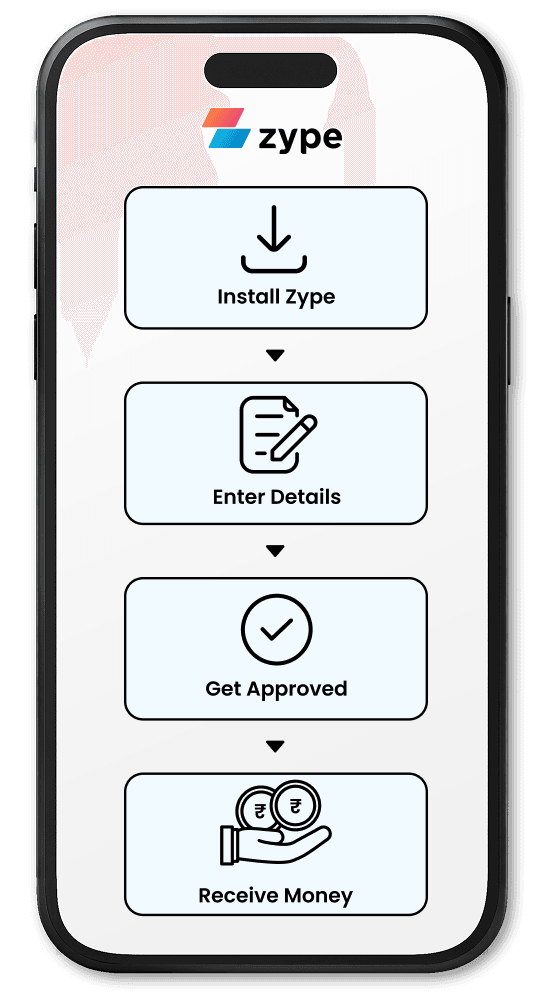

Looking for quick funds? Get our instant personal loan app like Zype designed for busy, salaried individuals who need funds in just a few minutes. Complete your application in under 6 minutes and unlock your loan limit instantly.

Here you can get super-fast loans with utmost ease. When you complete the loan application process after downloading the app which takes less than 6 minutes, your loan limit is unlocked.

With us, enjoy a loan experience that feels like a breeze. Here are our prominent features and benefits –

Gone are the days when you have to wait for multiple days to get your loan amount. It takes less than 6 minutes to complete the application process and less than 60 seconds to generate your loan offer.

Your quest for a personal loan upto 30000 with an affordable interest rate ends here. Interest rates on loans start at 1.5% per month.

Enjoy the seamless experience of borrowing unsecured loans from us as there is no need to pledge any asset to transfer money from the loan limit to your account.

We gives EMI options of 6, 9, 12 or 18 months so you can choose the tenure that best fits your budget.

No need to upload any documents. We only ask for basic information like name, mobile number, PAN, employment details and Aadhaar number.

Before taking a loan, you should always check the EMI amount you would have to pay for different loan tenures. This helps you to select the number of EMIs that best suits your budget.

Use this formula to calculate your EMIs.

E = P x R x (1+R)^N / [(1+R)^N-1], where

E is your personal loan EMI amount

P is the amount you are borrowing from the loan provider

R is the monthly interest rate

N is the no. of months of EMI payment

You can also use the personal loan EMI calculator to know your EMI amount quickly and easily.

Repaying EMIs on us is as convenient as availing the loan. You get to choose from the personal loan repayment tenures of 6, 9, 12 or 18 months.

There is also our easy-to-use EMI calculator. Use it before you finalise your EMI tenure so you can manage your finances in the best possible way.

| Loan Amount (₹) | Interest Rate (%) | Tenure (in months) | EMI (₹) |

|---|---|---|---|

| 30,000 | 18 | 6 | 5,265.76 |

| 30,000 | 18 | 9 | 3,588.29 |

| 30,000 | 18 | 12 | 2,750.40 |

| 30,000 | 18 | 18 | 1,914.17 |

Note: The above table is just for illustration purpose. The actual number may differ.

When you take a loan from us, the interest rate charged depends on your repayment history and credit score. If you have a healthy credit profile, you get loans at lower interest rates.

Our loans are very cost-effective and you also get complete information about your loan terms. With us, you never have to worry about any type of hidden charges.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting at as low as 1.5% (monthly) |

| Loan Processing Charges | Processing fees from 2% to 6% on every loan |

| Penalty on Overdue EMIs | Overdue interest and late payment penalty charges will be charged to your total outstanding loan on a daily basis |

It only takes a few simple and quick steps to complete the loan application on us. Before starting the process to get a ₹30000 personal loan, check if you fulfil the eligibility criteria.

21 years or above

Valid PAN & Aadhaar card

Salaried individual

Monthly income of at least ₹15,000

Applying for a 30000 emergency loan with our simple and requires minimal documentation. Here’s what you’ll need:

Once your loan offer is generated, you will be required to do a selfie-based verification. There is no need to upload any documents as this is an online verification process.

We does not ask to upload any required documents or for any kind of physical paperwork. To get an urgent loan of ₹30000, you will only need to enter your PAN and Aadhaar number along with a few other basic details.

It’s not compulsory to submit your income proof. However, if you are not satisfied with your loan offer, you get the option to upload the bank statement of the last four months. Based on this, you would be offered an updated loan limit.

A ₹30,000 instant loan is ideal for handling urgent, everyday expenses without dipping into your savings. It offers quick access to funds with zero paperwork and fast disbursal. It is a perfect option for those small but important moments when you need money quickly.

Use it to cover unexpected medical expenses like doctor consultations, medicines, or diagnostic tests, so you or your loved ones can get timely care without worrying about cash flow.

Need to pay school or college fees, buy books, or sign up for an online course? This small loan helps you invest in learning without waiting for your next salary.

Manage last-minute wedding essentials like gifts, outfits, or decor. A ₹30,000 loan makes sure you don’t miss out on those special touches during important occasions.

Whether it’s booking tickets, paying for fuel, or arranging accommodation, this loan helps you manage sudden travel plans with ease and confidence.

Fix small repairs at home like a leaking tap, broken switch, or paint touch-up. You can also use it to buy or upgrade basic home items without delay.

Apply on Zype in just a few simple steps and get approved for a loan within minutes. Enjoy minimal documentation, flexible EMIs, customizable tenure, and quick disbursal – all powered by a 100% digital experience

For a ₹30,000 Loan, EMI depends on the loan tenure, interest rate, and processing fees. A lower interest rate or a longer tenure can reduce your monthly EMI, but may increase overall interest.

Zype offers instant ₹30,000 loans even without traditional income proof. Alternative documents like bank statements or PAN and Aadhaar-based verification might be enough for approval.

A CIBIL score above 650 is generally preferred for a ₹30,000 Personal Loan

Yes, it’s possible. Some lenders consider cash salary applicants if they can submit bank deposits, Aadhaar, or utility bills as proof of consistent income.

Yes! Personal loans up to ₹30,000 are unsecured, so you don’t need to pledge any asset or collateral. Just a valid ID and steady income are usually enough.

Most loan apps like Zype allows you to select your EMI by adjusting the tenure (like 6 to 18 months). Use an EMI calculator to find a plan that suits your monthly budget.

Yes, some lenders allow you to get a ₹30,000 loan without standard income proof. They might assess your bank statement, utility payments, or UPI transaction history instead.

Minimal documents are required with most digital loan apps like Zype. Usually, your Aadhaar, PAN, and selfie are enough. No lengthy paperwork or office visits needed.

To get a ₹30,000 personal loan instantly on Zype, just click ‘Apply Online’, verify your phone number with OTP, complete your KYC, and get the money in minutes. No paperwork needed.

You need to be 21+, have a valid Aadhaar/PAN, and ideally show regular income—whether through job, freelancing, or small business. Some platforms also allow cash earners.

With loan apps like Zype, the process takes just 5–10 minutes for application. Once approved, the ₹30,000 is usually credited to your account instantly or within one day.

Most lenders offer flexible tenures. Personal loan apps like Zype offer tenure from 6 to 18 months—so you can choose what suits your monthly budget.

Yes, especially if you can provide bank statements or proof of consistent income through other means like rent, commissions, or UPI transactions.

Many loan apps use Aadhaar-based KYC. Just enter your Aadhaar, verify with OTP, and get the loan if eligible—no need for physical documents or in-person visits.

Download the Zype app, complete your profile and KYC, and check your approved loan limit in just a few taps. It’s fast, paperless, and super user-friendly.

Select the loan details you want to know

Copyright © 2025 Easy Platform Services Pvt Ltd. All rights reserved.