When it comes to borrowing, personal loans are one of the most flexible and accessible financing options available today. Whether you’re covering medical expenses, consolidating debt, renovating your home, or funding higher education, understanding the features of personal loan schemes is essential to making an informed choice.

In this guide, we will break down the most important personal loan features, compare loan plans offered by different lenders, highlight hidden charges to watch out for, and answer the most common questions borrowers have.

Table of Contents

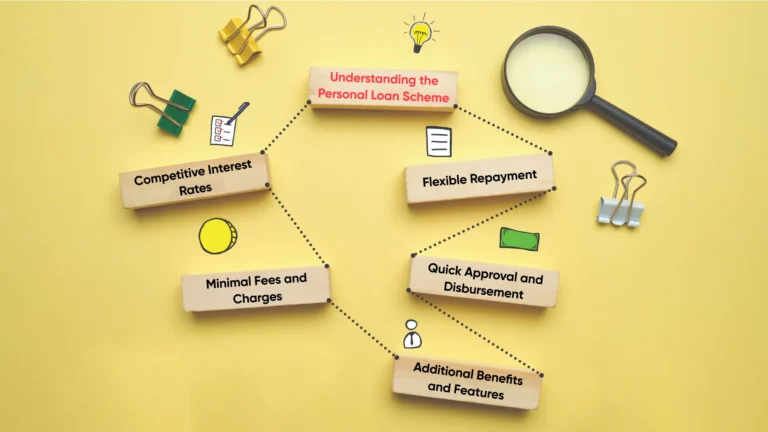

ToggleUnderstanding the Personal Loan Scheme

Personal loan schemes are a common financial tool for individuals seeking funds for various purposes. This can be for anything from home renovations, education expenses, or even debt consolidation. These schemes offer borrowers a certain amount based on their eligibility with a predetermined repayment period and interest rate. Understanding the intricacies of personal loan schemes can help you choose the best terms of borrowing.

5 Key Features to Consider

Understanding these features of personal loan helps you assess whether a loan is cost-effective, manageable, and suited to your financial goals.

1. Competitive Interest Rates

The interest rate directly impacts your EMI (Equated Monthly Installment) and the overall cost of borrowing.

- Fixed vs. Floating Rates: Most personal loan schemes come with fixed rates, but some lenders may offer floating options.

- Annual Percentage Rate (APR): Instead of only checking the advertised rate, always calculate APR – which includes processing fees and other charges – for the true cost of borrowing.

- Influencing Factors: Your credit score, employment stability, loan amount, and lender policies play a big role in determining the interest rate you qualify for.

2. Flexible Repayment Options and Loan Tenure

Repayment flexibility is a major benefit of personal loan plans. Lenders typically offer tenures ranging from 12 to 60 months, with EMIs spread accordingly.

- Short Tenure = Higher EMIs, lower interest outgo.

- Long Tenure = Lower EMIs, but higher overall interest.

- Part-Payment / Prepayment Options: Some lenders allow early repayment with minimal or no charges.

- Custom EMI Plans: A few fintech lenders even offer step-up or step-down EMIs tailored to cash flow.

3. Transparent Fees, Charges and Penalties in Personal Loan Schemes

Hidden charges can make a loan more expensive than it appears. Always ask lenders for a complete fee sheet before signing.

Common charges include:

- Processing Fees: Usually 1%–3% of the loan amount.

- Prepayment / Foreclosure Charges: May apply if you repay early.

- Late Payment Fees: Penalties for missed EMIs.

- Loan Insurance Premium: Optional, but often bundled.

4. Quick Approval, Disbursal & Minimal Documentation

Speed is one of the top benefits of personal loan schemes. Traditional banks may take several days, while digital-first lenders can disburse within minutes to 24 hours.

Minimal documentation usually includes:

- Identity proof (PAN / Aadhaar)

- Address proof

- Income proof (salary slips, ITR, bank statements)

5. Additional Benefits of Personal Loan Plans – Insurance, Rewards & More

Beyond the basics, some lenders provide extra perks:

- Loan Protection Insurance: Covers EMI payments in case of job loss, disability, or death.

- Pre-approved Top-Up Loans: For repeat borrowers with good repayment history.

- Reward Programs: Cashback or discounts on partner services.

- Dedicated Customer Support: Priority helplines or relationship managers.

These personal loan benefits can reduce financial stress during emergencies and add more value to your borrowing experience.

What Documentation Is Required To Apply For The Personal Loan Scheme?

Generally, to apply for a personal loan scheme, you will need to provide identification proof, address proof, and income proof. It’s important to check beforehand as lenders may have specific requirements.

Want to apply for a personal loan without any physical documentation? Look no further because with Zype, you only need your PAN and Aadhaar number to complete your application.

How to Apply for a Personal Loan?

Applying for a personal loan is a very straightforward process:

Research Lenders: Start by researching various lenders to find the one that offers the best terms and interest rates that suit your financial situation.

Check Eligibility: Review the eligibility criteria set by the lender, including minimum income requirements, credit score thresholds, and any other specific requirements

Gather Documentation: Collect all the necessary documents required for the application process. This typically includes identification proof, address proof, income proof (such as salary slips or tax returns), and bank statements.

Fill Out Application: Complete the loan application form provided by the lender. You can usually do this online through the lender’s website

Submit Application: Submit the filled-out application form along with the required documents to the lender. If applying online, you may need to upload scanned copies of the documents.

Wait for Approval: Once you’ve submitted your application, the lender will review your information and assess your eligibility for the loan. This process may take minutes to a couple of days, depending on the lender’s processing time.

Approval and Disbursal: If your loan application is approved, you’ll receive a loan offer detailing the terms and conditions. This includes the loan amount, interest rate, repayment schedule, and any other relevant information. Upon accepting the offer, the funds will be disbursed to your bank account.

Repayment: Make timely repayments according to the agreed-upon schedule. Set up automatic payments, if possible, to avoid missing any payments and incurring late fees.

Keep Track of Loan: Keep track of your loan account and statements to monitor your repayment progress and ensure accuracy.

Applying for a personal loan can be simplified with the assistance of personal finance apps like Zype. Its user-friendly platform streamlines the application process,which can be completed in less than 6 minutes.

From getting approved for a loan within 60 seconds to choosing among different repayment options Zype offers a convenient solution for managing your financial needs.

Just download the app from PlayStore/AppStore for an unmatched loan experience. Zype aims to make your financial journey smoother and more efficient.

With Zype, explore the possibilities and take control of your finances today.

Conclusion

When evaluating a personal loan scheme, consider features such as competitive interest rates, flexible repayment options, minimal fees, quick approval, and additional benefits like personal loan insurance schemes.

You can select a plan that best fits your financial requirements and objectives by carefully evaluating these factors. Remember to carefully go over the terms for a smooth borrowing experience.

Frequently Asked Questions

What Is The Most Important Thing To Consider When Evaluating Loan Options?

The most crucial factor to consider when evaluating loan options is the total cost of borrowing. This includes not only the interest rate but also any fees, charges, and repayment terms associated with the loan.

What Are The Criteria Used In Evaluating Loans?

A borrower’s credit history, income stability, employment status, debt-to-income ratio, and collateral (if applicable) are just a few of the factors that lenders consider when evaluating loans. Lenders use these indicators to evaluate the borrower’s creditworthiness and calculate the risk of lending the loan.

How Do Interest Rates Impact The Overall Cost Of A Personal Loan?

Interest rates significantly impact the overall cost of a personal loan. Higher interest rates result in higher monthly payments and total interest paid over the loan term. This increases the overall cost of borrowing. Lower interest rates, on the other hand, translate to lower monthly payments and reduced total interest expenses.

What Are The Benefits Of Flexible Repayment Options In A Personal Loan Scheme?

Flexible repayment options in a personal loan scheme offer borrowers greater control and adaptability in managing their finances. They allow borrowers to tailor their repayment schedules according to their cash flow, budget, and financial goals. This makes it easier to stay on track with payments and avoid default.

Are There Any Additional Fees Or Charges Associated With The Personal Loan Scheme?

Yes, there might be additional fees or charges connected to personal loan schemes. This includes processing fees, prepayment penalties, late payment fees, and loan insurance premiums. Before agreeing to a loan, it is crucial to carefully read the terms and conditions to comprehend all relevant fees and charges.

How Long Does It Take For The Loan To Be Approved And Disbursed Under The Personal Loan Scheme?

A personal loan scheme’s approval and disbursement times may differ according on the borrower’s eligibility, the lender’s processing time, and the documentation requirements. Some lenders can approve and disburse loans quickly in as little as a few days while others might take up to several weeks. With Zype, you can get approved for a loan within 60 seconds and get a same day disbursal!

Can I Avail Of Any Additional Benefits Or Features With The Personal Loan Scheme?

Yes, draw in borrowers, several personal loan schemes offer additional benefits or features. These may include personal loan insurance schemes for financial protection, flexible repayment options, extra rewards, discounts on other financial products, and personalised customer service. It’s worth exploring these additional benefits to maximise the value of your loan.